Our asset management

Our most important aim

Kåpan’s most important aim is to deliver a long-term stable pension to our members. The assosiations investments are made based on achieving a good return at reasonable risk, low cost and where sustainability is an integrated part of investment management says Marie Giertz, Head of asset management.

Marie Gertz, Head of asset management

Balance between risk and return

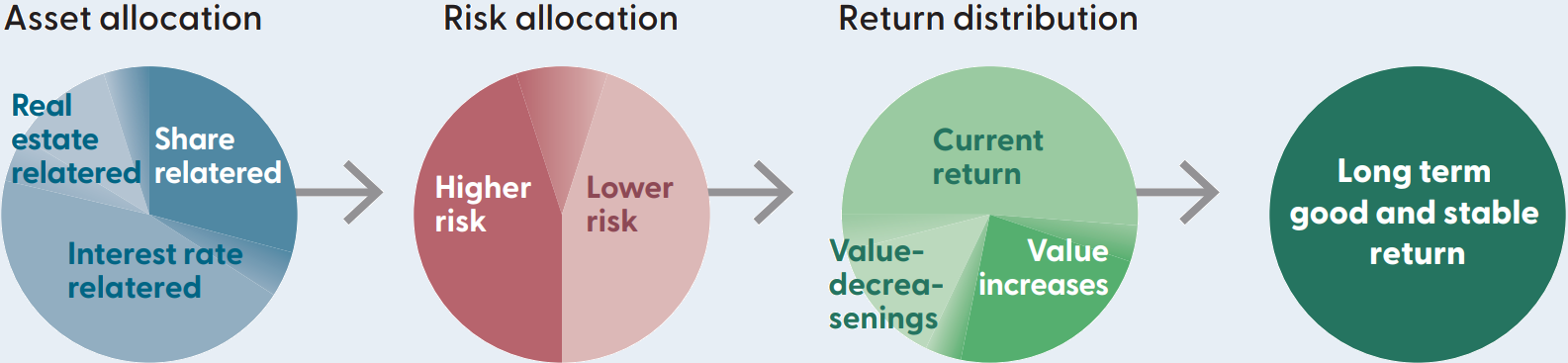

Managing assets within the framework of a traditional pension insurance relies on finding a balance between taking risks and expected returns. Capital is therefore invested based on the association’s risk policy which has been produced by the association’s Board. The policy stipulates that investments must be made in many different asset classes. Investments must also be made in many different securities so that no single investment constitutes too big a risk.

Our asset management model

We split the saved capital into three different age categories with different asset allocation between the three main investment areas. The allocation can vary within a range set by the Board in the society’s risk policy.

Our sustainability work

Our goal is to provide a long-term, stable pension to its savers. Kåpans's aims to do this at the lowest possible cost at the same time as we wish to contribute to a long-term sustainable development of society. To achieve this, we take environmental, social and economic aspects into account in our operations and in our investments. Read more about our sustainability work in our Sustainability report.

How we decide the risk distribution

We take your age into account to decide the risk distribution for your capital. If you are young and have a long time until you retire you will get a higher risk in your savings to give the possibility of a higher return. Investments with greater risk are expected to provide a higher return over time than more stable investments, but value development can fluctuate considerably more during this time. This means in turn that the risk in your savings reduces in step with your approaching retirement. When you are older you get more stability in your savings. When you are older you get more stability in your savings.

For the selectable part you can choose Kåpan Aktieval with higher risk in the savings than in our other products. In Kåpan Aktieval your capital is invested exclusively in equity until you start withdrawing your pension.

Your bonus rate

The bonus rate corresponds to the development of the assets. Kåpan has generation-based savings divided into three generation portfolios with different bonus rates. Your bonus rate corresponds to the development of the assets in your generation portfolio. Which generation portfolio you belong to depends on your age. Kåpan Aktieval has its own bonus rate that corresponds to the development of our equity portfolio.

Our consolidation level amounts to 100 percent at the end of each month

Collective consolidation level is a measure of the value of the assets that the association has in relation to the members' total insurance capital. According to our guidelines for consolidation, the value of our assets must be preliminarily distributed to all insurances each month. This means that the bonus interest rate is set so that the consolidation level amounts to 100 percent at the end of each month.